|

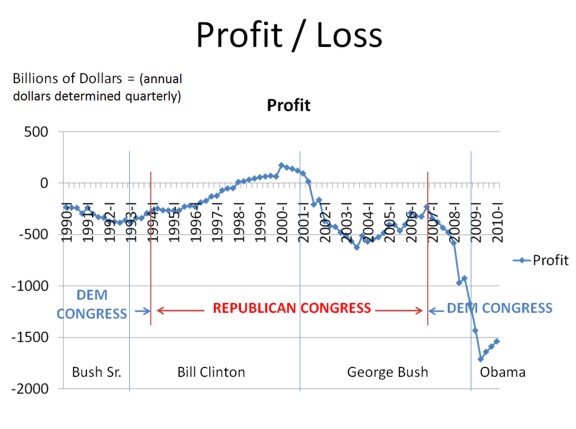

rpsoft 2000 PROFIT, 1990-2010 w. Congress Graphs, Charts From USA Data |

|

FORWARD

This section adds more analysis to the other graphs that are included under 1990-2010 grouping that are shown HERE. As we have mentioned elsewhere on our graphs, the data comes from the (BEA) US Bureau of Economic Analysis, and we just copied the data itself exactly. Of course the analysis can be much more complicated. Is US Government profit and loss a function of the Presidents only? Or of Congress only? Or of the combination? And how much is due to external factors such as wars, hurricanes and recessions that they may have to deal with but may not have caused? The analysis is far more complex than just what the numbers may show at first. While there can be many interpretations of the US period from 1990-2010, here is mine. And in this case, I went further than just looking at presidential terms, but also periods of congressional controls and also a closer look at the recessions themselves. What I believe I see here, is that one cannot just look at the presidents. The Congress in power may even have more control. And also there is the question of who makes recessions happen. So this is my opinion - at least the second level in looking at this period of time. I of course would be very interested in the opinions of others.

THE ARGUMENTS FOR BUSH AND REPUBLICANS, 1990-2010, second level analysis

While Bush was likely not an economic genius, he also was not as bad as Obama

and the Democrats keep suggesting. As a second point, let us look even closer

into Congress control during the same period. While I have shown the below graph

before, let me give you another opinion of it. And that opinion was that while

Bush was not the best economist, he did far better I believe than the Democratic

Congress or Obama. Profit here of course is mostly total US income (mostly IRS)

minus money spent.

If you look at the beginning of Bush's term in office, he was

hit by two recessions, and I do not think he was primarily responsible for

either. The first was the dot.com recession of 2001, where stocks held by some

technical companies on wall street were felt to be inflated in value and the

market dropped quickly, losing a fortune for many. I do not think we can blame

that one on Bush, but he got to fix it. And right after that recession on

9/11/2001 came another. That one was also not his fault of course since he had

little to do with those who flew planes into buildings. While the dot.com

recession was a stock market one, the 9/11 recession was a travel recession one

where Americans no longer wanted to fly airplanes - at least for a time.

Meanwhile, travel and vacations were far lower to places like Las Vegas and

such. So, cumulative, the downward drop down to -600 billion per year was likely

not directly his fault. Now look at the recovery attempt from 2003 to 2007. That

period appears at the least "not bad". While I do not believe that governments

can fix recessions, the governments can make the environment for fixing better.

So the bush tax cuts enacted in 2001 and 2003 seem to have made good progress -

allowing industry to fix itself. The slope of this curve in fact seems as good

or better than the good times of the Bill Clinton era. And this curve very much

looked like it would again get to profit except for the recession of 2008. And

so, the only real Bush concern I can see is - what about the recession of 2008?

Whose fault was that? Well, one thing literature on it seems to agree on is that

the 2008 recession was US caused based on bad housing mortgages. The problem was

made worse when bad housing mortgages to sub-prime lenders were bundled and sold

to many banks which caused many failures almost at the same time. While the

person at the top, Bush, must share some of the blame for this, recall that

after 2007 the Democrats now controlled Congress and specifically Chris Dodd and

Barney Frank were in charge of mortgage giants Fannie Mae and Freddie Mac. So

the crash of those two mortgage giants contributed seriously to the 2008

recession.

If one were to label the areas by Congress control instead of by presidents (as

also shown in the graph) then Democrats would be in control except for the years

1994-2006. Amazingly, those years of Republican Control from 1994 to 2006 were

some of the better years except for the recession hits. And the two recession

hits in that period at least appear to be mostly external to the US government.

So, what is true or not true? Obama says this week (9/8/10) that the war caused

most or all of US debt. Looking at the graph, that is rubbish. The war money was

in all of the years, and you can see 2007 was no worse than some points in the

Bill Clinton era. Obama says that the Bush tax cuts were bad. No, clearly the

Bush tax cuts were spurring a good recovery from 2003 -2007. Obama says 10 years

of Bush economics damaged the US. While Bush does not seem to be an economic

genius, his handling of the growth period of 2003 to 2007 seems decent. In

general, we may never know who did what exactly. However, based on the economic

facts, at this point, even Bush who I do not say was an economist seems to have

done far better in my book than the group of Obama, Chris Dodd, Barney Frank and

the Democrats. Note also that in the huge Obama bill to control industry such

that recessions never happen, oddly the bill did NOT include controls for Fannie

Mae and Freddie Mac, and also that Chris Dodd and Barney Frank were among the

writers for controlling OTHERS - while no one seems to be controlling them - who

may have in fact caused the last recession.

And yes, I am sure others may have different opinions of the above, and of course I would love to hear them.